CRM Software for Financial Advisors: 7 Powerful Tools to Skyrocket Client Success

Managing client relationships in the financial advisory world isn’t just about numbers—it’s about trust, timing, and personalized service. That’s where CRM software for financial advisors steps in as a game-changer.

Why CRM Software for Financial Advisors Is a Non-Negotiable

In today’s hyper-competitive financial services landscape, advisors can no longer rely on spreadsheets, sticky notes, or memory alone. The modern financial advisor manages dozens, if not hundreds, of client relationships—each with unique goals, risk profiles, and communication preferences. Without a centralized system, critical follow-ups get missed, compliance risks rise, and growth stalls.

CRM software for financial advisors is specifically designed to solve these challenges. Unlike generic CRMs, financial advisor-focused platforms integrate compliance tools, financial planning modules, and secure client communication features. They act as a command center for client interactions, ensuring no opportunity slips through the cracks.

Streamlining Client Onboarding

Onboarding a new client is one of the most critical—and often most time-consuming—phases in the advisory relationship. A robust CRM software for financial advisors automates much of this process, from intake forms to document collection and e-signatures.

For example, platforms like Redtail CRM allow advisors to send digital onboarding packets that clients can complete from their phones or tablets. This not only speeds up the process but also improves the client experience from day one.

- Automated document requests and reminders

- Secure e-signature integration

- Customizable onboarding workflows

By reducing manual data entry and follow-up, advisors can cut onboarding time by up to 50%, according to a 2023 industry report by Cerulli Associates.

Enhancing Client Communication & Engagement

Consistent, personalized communication is the cornerstone of client retention. CRM software for financial advisors enables advisors to schedule touchpoints, track communication history, and even automate outreach based on life events or market changes.

Imagine receiving an alert when a client’s child turns 18—perfect timing to discuss 529 plan options. Or automatically sending a market update after a significant downturn. These proactive touches build trust and position the advisor as a true partner.

Platforms like MoneyGuidePro integrate CRM features with financial planning tools, allowing advisors to send personalized planning updates directly from the platform.

“The best financial advisors don’t just manage money—they manage relationships. A CRM is the engine that makes that possible.” — Financial Advisor Magazine, 2023

Top 7 CRM Software for Financial Advisors in 2024

With so many options on the market, choosing the right CRM software for financial advisors can be overwhelming. To help narrow the field, we’ve evaluated the top seven platforms based on usability, integration capabilities, compliance support, and client engagement features.

1. Redtail CRM

Redtail has long been a favorite among independent financial advisors. Known for its clean interface and powerful automation, Redtail CRM offers a comprehensive suite of tools tailored to the financial services industry.

Key features include:

- Automated email campaigns with open tracking

- Two-way sync with Outlook and Gmail

- Document management with secure client portal access

- Compliance-friendly audit trails

Redtail also integrates with popular financial planning tools like Orion and Envestnet, making it a solid choice for firms already using those platforms. Its mobile app allows advisors to update client records on the go, a major plus for those who meet clients off-site.

One standout feature is its “Task Manager,” which helps advisors prioritize daily activities based on client importance and upcoming milestones. This level of organization is crucial for maintaining high-touch service across a growing client base.

2. Wealthbox

Wealthbox is another top-tier CRM software for financial advisors, particularly praised for its intuitive design and seamless Google Workspace integration. It’s ideal for advisors who live in Gmail and Google Calendar.

With Wealthbox, every email sent or received is automatically logged in the client’s profile. This eliminates the need to manually track correspondence and ensures a complete communication history.

- Smart email tracking and reminders

- Custom pipelines for client acquisition and service

- Client portal with document sharing and e-signatures

- Robust reporting and dashboard analytics

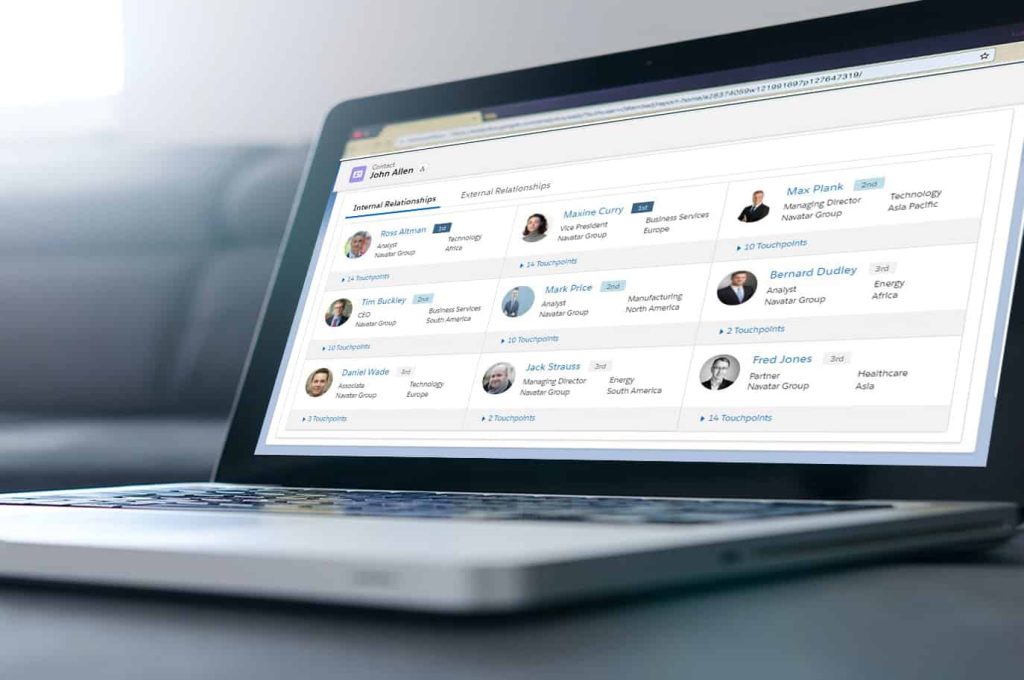

Wealthbox also offers a unique “Relationship Mapping” feature that visually displays a client’s family, business, and professional connections. This helps advisors identify cross-selling opportunities and deepen relationships.

According to user reviews on G2, Wealthbox scores high for ease of use and customer support, making it a great option for solo practitioners and small teams.

3. Salesforce Financial Services Cloud

For larger advisory firms or those part of enterprise broker-dealers, Salesforce Financial Services Cloud (FSC) offers unmatched scalability and customization. While it has a steeper learning curve, its power lies in its flexibility.

FSC is built on the Salesforce platform, meaning it can be customized to fit virtually any workflow. Advisors can create custom objects for financial plans, insurance policies, or estate documents. It also supports advanced automation through Salesforce Flow.

- AI-powered insights via Einstein Analytics

- Integration with custodians like Fidelity, Schwab, and TD Ameritrade

- Compliance and regulatory reporting tools

- Multi-advisor team collaboration features

One major advantage of Salesforce FSC is its ecosystem. With over 150,000 apps on the AppExchange, advisors can extend functionality with tools for portfolio management, marketing automation, and client education.

However, the complexity and cost mean it’s often overkill for small firms. Implementation typically requires a consultant, and ongoing maintenance can be resource-intensive.

How CRM Software for Financial Advisors Boosts Productivity

Time is the most valuable asset for any financial advisor. The average advisor spends less than 40% of their week on client-facing activities, according to a 2022 study by the CFA Institute. The rest is consumed by administrative tasks, compliance paperwork, and manual follow-ups.

CRM software for financial advisors directly addresses this inefficiency by automating repetitive tasks and centralizing information. This shift allows advisors to reclaim hours each week and reinvest that time into strategic planning and client growth.

Automating Routine Tasks

From birthday emails to quarterly review reminders, CRM software for financial advisors can automate a wide range of routine communications. These automations are not just time-savers—they ensure consistency and reduce the risk of human error.

For example, an advisor can set up a workflow that triggers a series of emails after a client signs a new agreement:

- Day 1: Welcome email with onboarding checklist

- Day 3: Introduction to financial planning process

- Day 7: Invitation to first planning meeting

These touchpoints keep the client engaged without requiring manual effort from the advisor. Over time, this builds a sense of reliability and professionalism.

Centralizing Client Data

One of the biggest productivity killers is data fragmentation. Client information scattered across email, spreadsheets, and paper files makes it difficult to get a 360-degree view of the relationship.

A good CRM software for financial advisors consolidates all client data into a single profile. This includes:

- Contact details and family information

- Financial goals and risk tolerance

- Meeting notes and action items

- Document history and signed agreements

With everything in one place, advisors can walk into a client meeting fully prepared, referencing past conversations and tracking progress toward goals. This level of preparation enhances credibility and deepens trust.

“Before our CRM, I spent 2 hours every Monday just catching up on emails and notes. Now, I spend that time calling clients. It’s transformed my practice.” — Sarah K., CFP, Independent Advisor

Compliance and Security: Non-Negotiables in CRM Software for Financial Advisors

Financial advisors operate in one of the most regulated industries. Any CRM software for financial advisors must meet strict compliance standards to protect client data and ensure audit readiness.

Key compliance features to look for include:

- Activity logging and audit trails

- Secure data encryption (both in transit and at rest)

- Role-based access controls

- Integration with compliance monitoring tools

Meeting FINRA and SEC Requirements

The Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) require advisors to retain records of all client communications for a minimum of three years. CRM software for financial advisors that automatically logs emails, calls, and meetings helps firms meet these requirements with ease.

Platforms like Redtail and Wealthbox offer FINRA-compliant archiving, ensuring that every interaction is captured and stored securely. Some even integrate with third-party archiving services like Smarsh or Global Relay for added compliance assurance.

Additionally, advisors must be able to produce records upon request. A CRM with robust search and reporting capabilities allows firms to quickly generate compliance reports, reducing the stress of audits.

Data Security Best Practices

Client data is a prime target for cyberattacks. A single breach can result in financial loss, reputational damage, and regulatory penalties. That’s why CRM software for financial advisors must prioritize security.

Look for platforms that offer:

- Two-factor authentication (2FA)

- Regular security audits and penetration testing

- GDPR and CCPA compliance

- Secure client portals with password protection

For example, Salesforce Financial Services Cloud undergoes annual SOC 1 and SOC 2 audits, providing enterprise-level security assurances. Smaller platforms like Wealthbox also maintain high standards, with data encrypted using AES-256 encryption.

Advisors should also implement internal security policies, such as requiring strong passwords and limiting access to sensitive data based on role.

Integration Capabilities: Why Your CRM Shouldn’t Work in Isolation

A CRM is only as powerful as its ability to connect with other tools in your tech stack. The best CRM software for financial advisors integrates seamlessly with portfolio management systems, financial planning software, email marketing platforms, and custodial data feeds.

Without integration, advisors end up manually exporting and importing data—time-consuming and error-prone.

Syncing with Custodial Platforms

Real-time account data is essential for accurate financial planning and client reporting. CRM software for financial advisors that integrates with custodians like Charles Schwab, Fidelity, or TD Ameritrade can automatically pull in account balances, transaction history, and performance data.

For example, Redtail CRM offers direct integration with Schwab’s Institutional Services, allowing advisors to view client holdings without logging into multiple systems. This not only saves time but also ensures data accuracy.

Some platforms, like Orion Connect, go a step further by offering a unified dashboard that combines CRM, portfolio management, and reporting in one interface.

Connecting with Financial Planning Tools

Financial planning is at the heart of the advisory relationship. CRM software for financial advisors that integrates with planning tools like eMoney, MoneyGuidePro, or RightCapital allows advisors to sync goals, cash flow projections, and retirement scenarios directly into the client profile.

This integration eliminates duplication of effort and ensures that planning data is always up to date. For example, if a client updates their income in MoneyGuidePro, that change can automatically reflect in the CRM, triggering a follow-up task for the advisor.

It also enhances the client experience. Advisors can share interactive planning dashboards through the CRM’s client portal, making complex financial concepts easier to understand.

“Integration is the key to scalability. Without it, growth creates chaos.” — Tech Advisor for RIAs, 2023

Choosing the Right CRM Software for Financial Advisors: A Step-by-Step Guide

Selecting the right CRM software for financial advisors isn’t a one-size-fits-all decision. It requires careful evaluation of your firm’s size, workflow, budget, and long-term goals.

Assess Your Firm’s Needs

Start by mapping out your current processes. Where are the bottlenecks? What tasks consume the most time? Are you struggling with client retention, onboarding delays, or compliance tracking?

For example, a solo advisor might prioritize ease of use and affordability, while a multi-advisor firm may need advanced team collaboration and reporting features.

Create a list of must-have features, such as:

- Email integration

- Client portal

- Task automation

- Compliance logging

- Mobile access

Test Before You Invest

Most CRM software for financial advisors offers free trials or live demos. Take advantage of these to test the platform in real-world scenarios.

Import a few client records (anonymized if necessary) and try completing common tasks like scheduling a meeting, sending an email, or generating a report. Pay attention to:

- User interface and navigation

- Speed and responsiveness

- Quality of customer support

- Learning curve for your team

Ask your team for feedback. If the CRM feels clunky or unintuitive, adoption will be low—rendering the investment ineffective.

Consider Total Cost of Ownership

While monthly subscription fees are important, they’re only part of the picture. Consider:

- Implementation and setup costs

- Training time and resources

- Integration fees with other platforms

- Support and maintenance

For example, Salesforce FSC may have a high upfront cost, but its long-term value for a growing firm can justify the investment. On the other hand, Wealthbox offers a lower entry price with predictable monthly billing, ideal for small firms.

The Future of CRM Software for Financial Advisors

The role of CRM software for financial advisors is evolving rapidly. As client expectations rise and technology advances, the next generation of CRMs will be more intelligent, proactive, and integrated than ever before.

AI-Powered Insights and Predictive Analytics

Artificial intelligence is transforming CRM platforms from passive databases into active advisory partners. Future CRM software for financial advisors will use AI to analyze client behavior, predict life events, and recommend next steps.

Imagine a system that detects a client’s frequent logins to their retirement plan and suggests a review meeting. Or one that flags a sudden drop in portfolio risk tolerance and prompts a conversation about market anxiety.

Salesforce Einstein and Redtail’s AI features are early examples of this trend. As machine learning improves, these capabilities will become standard.

Hyper-Personalization at Scale

Today’s clients expect personalized service—but advisors can’t manually tailor every interaction for hundreds of clients. CRM software for financial advisors will increasingly use data to deliver hyper-personalized content and communication.

For example, a CRM could automatically send a client an article about college savings when their child reaches age 15, or a tax strategy tip after a major account contribution.

This level of personalization strengthens relationships and positions the advisor as a proactive guide, not just a quarterly reporter.

Deeper Ecosystem Integration

The future CRM won’t be a standalone tool—it will be the central hub of a fully connected financial ecosystem. Expect deeper integrations with banking, insurance, estate planning, and even healthcare platforms.

As open banking and data-sharing standards evolve, CRMs will pull in holistic financial data, giving advisors a complete picture of a client’s financial life.

“The CRM of the future won’t just track relationships—it will anticipate them.” — Fintech Trends Report, 2024

What is CRM software for financial advisors?

CRM software for financial advisors is a specialized platform designed to help financial professionals manage client relationships, streamline workflows, automate communications, and ensure compliance. It centralizes client data, tracks interactions, and integrates with financial planning and portfolio management tools to enhance service delivery.

Why do financial advisors need a CRM?

Financial advisors need a CRM to improve client retention, increase efficiency, ensure compliance, and scale their practice. Without a CRM, advisors risk missing critical follow-ups, violating regulatory requirements, and spending too much time on administrative tasks instead of client service.

What features should I look for in CRM software for financial advisors?

Key features include client data centralization, automated workflows, email integration, secure client portal, compliance logging, custodial data sync, financial planning integration, mobile access, and robust reporting. Security and ease of use are also critical factors.

How much does CRM software for financial advisors cost?

Costs vary widely. Entry-level CRMs like Wealthbox start at around $50/user/month, while enterprise solutions like Salesforce Financial Services Cloud can exceed $300/user/month. Implementation, training, and integration fees may also apply.

Can CRM software help with client acquisition?

Yes. CRM software for financial advisors supports client acquisition through automated marketing campaigns, lead tracking, referral management, and analytics that identify high-potential prospects. It helps convert leads into clients by ensuring timely, personalized follow-up.

CRM software for financial advisors is no longer a luxury—it’s a necessity. From streamlining onboarding to ensuring compliance and enabling hyper-personalized service, the right CRM can transform how advisors work and grow. As technology evolves, the most successful firms will be those that leverage CRM platforms not just to manage relationships, but to anticipate client needs and deliver exceptional value at scale. Whether you’re a solo practitioner or part of a large firm, investing in the right CRM is one of the smartest moves you can make for your practice’s future.

Recommended for you 👇

Further Reading: